Lease administration is an important process helping you stay on top of your lease portfolios. Typically, when we come across the term, lease administration, one of the first things that comes to mind is Common Area Maintenance (CAM) audit and reconciliation. However there’s a lot more to the lease administration process than just CAM reconciliation and lease audits. While CAM reconciliation is one the core tasks and most time-consuming, there are other equally important processes that are a part of lease administration. This blog post sheds light on them. They are-

Renewal notice processing

Renewal is the option to extend the term of the lease after the expiration of the existing lease term. Renewal clauses give the tenant the right to extend the lease term for a specified period of time and at a pre-defined rental rate. However, for the renewal to take effect, the tenant has to provide a notice to the landlord within the time frame specified in the lease. Sometimes, leases have automatic renewal clauses in which case, the lease automatically renews for the next term at a said rental rate if the tenant doesn’t provide a notice to terminate it. In both cases, as we can see, there’s a need to provide notice to the landlord within a stipulated period before the existing lease term expires. Lease administrators should track such critical dates and notice requirements and either alert the tenant about them so they can send the notice or send the notice on behalf of the tenant if the tenant has authorized them to do so.

Estoppel notice processing

Estoppel certificates are usually created by the Tenant for Landlord’s use. If the Landlord is in talks with a prospective buyer for their property, or with a lender who secures the loan with an interest in the said property, they may require the Landlord to furnish an estoppel certificate. The prospective lender or buyer of the property may use in their “due diligence” review of the property. The tenant is usually given a time frame of 10 or 20 days within which they have to submit the estoppel certificate to the landlord. Lease administrators in the tenant’s organization are responsible for timely processing of such estoppel notices.

Security deposit returns management

Security deposit is a lumpsum amount paid by the tenant to the landlord as a guarantee for the performance of lease obligations. Security deposits are usually refundable and returned to the tenant at the end of the lease term, provided there is no damage to the property and the tenant has fulfilled all their obligations under the lease. It is the responsibility of the landlord to refund the security deposit within the timeframe stipulated in the lease after the property is handed over back to the landlord by the tenant. If the landlord fails to return the security deposit on time, they are liable to pay penalty to the tenant along with the security deposit amount. Lease administrators on the landlord’s side are responsible for ensuring the security deposit returns happen on time, so the landlord is not in default and thus not liable to pay any penalty. At the same time, lease administrators on the tenant’s team are responsible for ensuring that the security deposit amount is received on time and is accurate.

Rent increase management

Lease administrators are also responsible for managing the increase in rental rates as per the leases. From the landlord’s perspective, their lease administrators are responsible for keeping track of rent increase dates, reviewing the lease clauses related to the rent increase, calculate the new rent as per those and then communicate the same to the tenants within the stipulated time period. At the tenant’s end, the lease administrator is responsible for reviewing the lease clauses related to rent increase and confirm if the rent amount increase specified by the landlord is correct and process the payment if it is accurate while contesting it if the landlord’s calculations are not accurate.

Subordination and non-disturbance agreement (SNDA)

From the landlord’s perspective, their lease administrators assist the landlord in generating SNDA for property sale or debt financing. From the tenant’s perspective, the lease administrators are responsible for updating their lease administration platform in the event of change of landlord or any other obligation related to the SNDA.

Commencement date letters

Lease administrators manage commencement dates and rent commencement dates as per the lease. From the landlord’s perspective, their lease administrators are responsible for reviewing the lease clauses related to commencement date and rent commencement date, keeping track of them and communicating the same to tenants. At the tenant’s end, the lease administrator is responsible for reviewing and updating the rent/lease commencement letters received from the landlord and updating them in the tenant’s lease administration software and process related rental payments accordingly.

Liasoning services

Lease administrators are also responsible for communicating with tenant/landlord/other parties for lease-related processes and ensuring such processes run smoothly and are taken care of on time.

Outsourcing your lease administration process or looking to hire a lease administrator? Make sure your new lease administrators are adept at all of the above services and not just CAM!

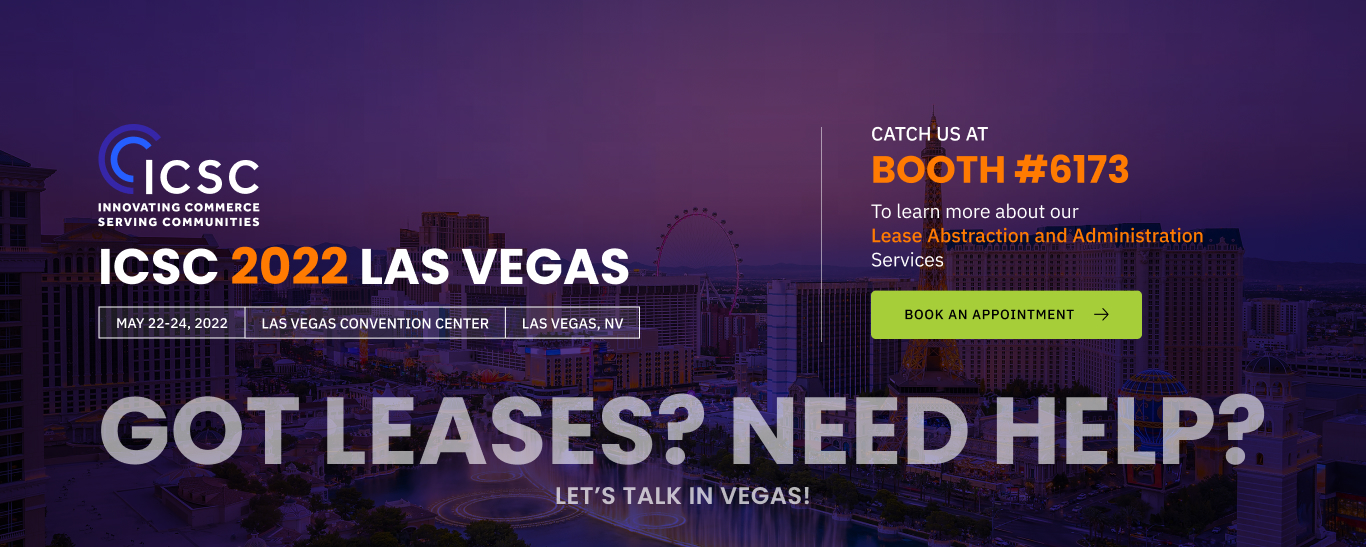

Rebolease.com, powered by RE BackOffice, Inc., is a premier provider of lease abstraction, administration, audit and accounting services. Headquartered in Pittsburgh, PA, we are a global boutique firm, providing high-quality services to top-tier clients across industry verticals, covering every type of lease and on any lease platform. We are proud to be a trusted partner, for 15+ years, to leading retailers, REITs, property owners/managers, and corporate accounts seeking a strategic advantage. All client projects are performed in-house.